lake county real estate taxes indiana

Ad View County Assessor Records Online to Find the Property Taxes on Any Address. Disabled veterans living in Indiana can benefit from a property tax deduction if they served at least 90 days of honorable military service and are totally disabled or are at least 62 years old and 10 percent or more disabled.

Any changes to the tax roll name address location assessed value must be processed through the Lake County Property Appraisers Office 352 253-2150.

. Check out your options for paying your property tax bill. Ad valorem taxes are levied on real estate property and are based on the assessed value of the. CARI MCGEE REAL ESTATE TEAM KELLER WILLIAMS COLUMBIA BASIN.

Please note there is a nomimal convenience fee charged for these services. The median property tax on a 13540000 house is 115090 in Indiana. Filing online is SAFE and SECURE.

2022 Lake County Budget Order - Issued January 13 2022. You may then pre-file for your 2023 tax year homestead exemption. Median Property Taxes No Mortgage 1395.

Your Indiana Adjusted Gross Income AGI is less than 18600. Physical Address 18 N County Street Waukegan IL 60085. As your Lake County Property Appraiser Im working to improve this site with information important to Lake County home and.

The order also gives the total tax rate for each taxing district. Its Fast Easy. File Tax Exemptions Online.

As part of our commitment to provide our customers with efficient and convenient service The Treasurers Office now offers tax payments over the Internet using major credit cards and e-checks. The assessors offices are working in the 2021. As part of our commitment to provide our customers with efficient and convenient service The Treasurers Office now offers tax payments over the Internet using major credit cards and e-checks.

701 Abbot St Richland WA 99352. Lake County has one of the highest median property taxes in the United States and is ranked 540th of the 3143 counties in order of median property taxes. You are not claiming the Homeowners Residential Property Tax Deduction.

- House for sale. Certain types of Tax Records are available to the general. 1 day on Zillow.

That is a question that comes up for any taxpayer just in case you have a property is located in Lake County Indiana. The median property tax on a 13540000 house is 185498 in Lake County. These fees are not retained by Lake County and therefore are not refundable.

The Lake County Treasurer and Tax Collectors Office is part of the Lake County Finance Department that encompasses all financial functions of. Office of the Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Phone. 352-253-2150 Lake County.

Lake County collects on average 137 of a propertys assessed fair market value as property tax. You may be eligible to claim a Lake County Indiana residential income tax credit if you meet ALL THREE of the following requirements. Please note there is a nomimal convenience fee charged for these services.

Jordan Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Under FS. Welcome to the Lake County Assessors citizen engagement site. 2021 Lake County Budget Order AMENDED - Issued.

The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021. Lake County IL 18 N County Street Waukegan IL 60085 Phone. The order contains the states certification of the approved budget the certified net assessed value the tax rate and the levy for each fund of each taxing unit in a county.

This exemption provides a deduction in assessed property value. Main Street Crown Point IN 46307 Phone. The exact property tax levied depends on the county in Indiana the property is located in.

The Lake County Community Economic Development Department will hold a public hearing on the preparation of its one-year 2022 Annual Action Plan at 400 PM on Monday June 13th 2022 in the Lake County Community Economic Development Department office at the Lake County Government Complex located at 2293 North Main Street Room A-310 Crown. Senior citizens as well as all homeowners in Indiana can claim a tax deduction if their home serves as their primary residence. 6686076 email addresses are public.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. These records can include Lake County property tax assessments and assessment challenges appraisals and income taxes. The deduction amount equals either 60 percent of the assessed value of the home or a maximum of 45000.

35 Apple Acres UNIT 112 Chelan WA 98816. Lake County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lake County Indiana. Lake County collects on average 137 of a propertys assessed fair market value as.

You paid property tax to Lake County Indiana on your residence. 80 of all new homeowners file online in less than 15 minutes. Download a Full Property Report with Tax Assessment Values More.

Please note there is a nomimal convenience fee charged for these services. 847-377-2000 Contact Us Parking and Directions. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe.

Ad valorem is a Latin phrase meaning according to worth. We are proud to. The median property tax in Lake County Indiana is 1852 per year for a home worth the median value of 135400.

The Lake County Treasurers Office located in Crown Point Indiana is responsible for financial transactions including issuing Lake County tax bills collecting personal and real property tax payments. Request Child Support Payment History. Hamilton County collects the highest property tax in Indiana levying an average of 227400 108 of median home value yearly in property taxes while Orange County has the lowest property tax in the state collecting an average tax of 51500 057.

The median property tax on a 13540000 house is 142170 in the United States. Where can I access public records. CUSTODIAN OF PUBLIC RECORDS.

These fees are not retained by Lake County and therefore are not refundable. These veterans can claim a 12480 annual deduction as long as their homes are not valued at more than 113000. To pay your property tax by phone call 3173274TAX 4829 or 18888818986.

File Property Tax Deduction. The median property tax in Lake County Indiana is 1852 per year for a home worth the median value of 135400. To produce fair and equitable assessments of all taxable real estate using both proven and innovative methods while delivering exceptional service to the public.

Assessor County Townships Directory of Lake County Townships. In accordance with 2017-21 Laws of Florida 119 Florida Statutes.

St John Indiana Ranch Home For Sale 46373 Ranch Homes For Sale Ranch House Home

Your Guide To Prorated Taxes In A Real Estate Transaction

Salem Wi Real Estate Salem Homes For Sale Realtor Com

Indiana Property Tax Calculator Smartasset

/gettyimages-1299026418-1024x1024-53a7a37a410d4c749c0060f7bcc7f813.jpeg)

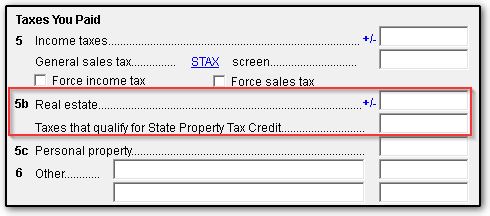

Real Estate Taxes Vs Personal Property Taxes

Lynnville In Real Estate Lynnville Homes For Sale Realtor Com

Tennyson Real Estate Tennyson In Homes For Sale Zillow

Pendleton Real Estate Pendleton In Homes For Sale Zillow

Oxford In Real Estate Oxford Homes For Sale Realtor Com

Waterfront Property Featuring Beautiful Long Frontage On The Nomini Creek Which Leads Into Nomini Bay On The Potom Cropland Waterfront Property Potomac River

Watertown Ny Real Estate Watertown Homes For Sale Realtor Com

Vernon Wi Real Estate Vernon Homes For Sale Realtor Com

Carlisle In Real Estate Carlisle Homes For Sale Realtor Com

How To Compute Real Estate Tax Proration And Tax Credits Illinois